Bitcoin Price Pump Imminent Above $30k As Sharks and Whales Snatch Stablecoins in Droves

Bitcoin Price Stable Above $30k Post CPI Data Release

Bitcoin price is trading 1.1% up to $30,295 on Thursday following the release of the CPI data, which impressed investors with inflation falling to its lowest annual level over two years in June.

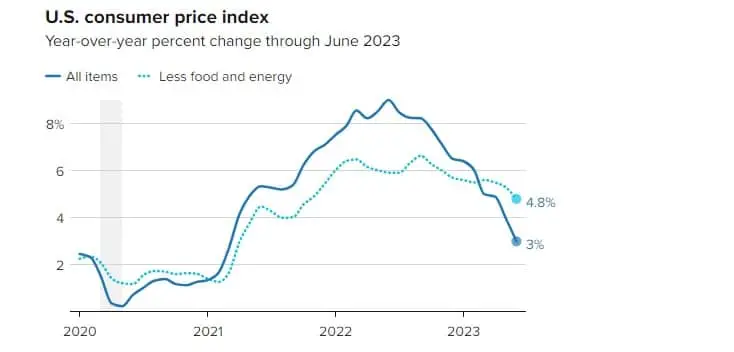

The CPI rose 3% from the previous year, marking the lowest it has gone since March 2021—and a drop from 4% a month ago.

In comparison, goods and services increased by 0.2% month-over-month. The results, which the Fed will use in addition to another economic indicator to make the next decision on interest rates, triumphed Dow Jones’ estimates that the CPI would rise by 3.1% and 0.3%, respectively.

In June, the regulator paused interest rate hikes but remarked that further increases would be necessitated later in the year based on how the economy reacts.

Recommended Articles

Although the CPI came in better than expected, it remains to be seen how the Fed will react, especially with some officials leaning toward a 25 basis points increase.

On the other hand, while investors remain unmotivated by the CPI due to the hawkishness portrayed by the Fed in early June, projections for a Bitcoin price surge to $120,000 by the end of 2024 are surfacing.

Bitcoin Price Bullish Outlook Plus Investor Activity

As Bitcoin price upholds support above $30,000 for the third week in a row, network data reveals investors are adamant about offloading their wallets. According to the head of data and analytics at FRNT Financial, Strahinja Savic, idle Bitcoin supply in the last two years has jumped to an all-time high, almost hitting 70%.

“This data suggests that the dominant bitcoin investor right now is the long-term ‘holder,’” Savic stated in a written statement to CoinDesk. “This cohort is less likely to be sensitive to macro considerations.”

Meanwhile, on-chain data and insights from Santiment, a popular analytics platform, found that “Whales and Sharks are watching the $30k and $31k Bitcoin price ranging, just like the rest of traders.”

One interesting revelation is that shark and whale addresses are gobbling stablecoins such as USDP and DAI at a high rate. This uptake of stablecoins implies possible “future big crypto buys” and increases the probability of price pumps.

🐳🦈 Sharks and Whales are watching the $30k to $31k #Bitcoin price ranging, just like the rest of traders. And it appears that they are accumulating #stablecoins like $USDP & $DAI quite rapidly, which increases the probability of future big #crypto buys. https://t.co/IsW0xJFsd9 pic.twitter.com/wkrr0bDQGL

— Santiment (@santimentfeed) July 12, 2023

Bitcoin Price Calm Before Breakout?

The 100-day Exponential Moving Average (EMA) (in blue) reinforces Bitcoin’s position above $30,000 on the four-hour chart. A breakout is also in the offing based on the Bollinger Bands.

When the bands are narrow, the market is consolidating, meaning that prices are moving sideways with low volatility.

Traders can use Bollinger Bands to identify potential breakouts or reversals by looking for price patterns such as squeezes, double tops or bottoms, or candlestick formations.

If Bitcoin continues to uphold support, a bullish breakout to $35,000 and possibly $38,000 would be imminent – bolstered by the rising demand for BTC and the willingness exhibited by investors to HODL.

Traders would be on the lookout for a break above the immediate support at $31,000 and the subsequent seller congestion at $32,000. On the downside, failure to keep support at $30,000 intact might validate a sell-off to $28,000 and $25,000, respectively.

Related Articles

- US Govt Selling Silk Road Related Bitcoin, Crypto Crash Ahead?

- Cardano Founder Gives Algorand a Hard-Sell Proposition

- Coinbase Stock Defies Lawsuit And Crypto Winter; $COIN Price Shoots By 16%