Bitcoin fees nosedive 64% in a week; What does it mean?

As the price of Bitcoin (BTC) continues to lean bearish and stagnate around the $64,000 mark, far beneath the all-time high (ATH) achieved in March this year and just above a critical demand zone, on-chain activity has faltered alongside, and total Bitcoin transaction fees have plummeted by over 60%.

Specifically, the total transaction fees on Bitcoin’s network have experienced a significant decrease of a staggering 64%, bringing down the figure to $19.2 million, according to the data shared by blockchain and cryptocurrency analytics platform IntoTheBlock in an X post on June 21.

Indeed, Bitcoin transaction fees typically reflect activity on its network and their decline suggests a lack thereof. And vice versa, these costs can spike during periods of congestion on the network, as it happened during the 2017 crypto boom when average fees reached nearly $60 per transaction.

Picks for you

What this means for Bitcoin price

At the same time, such a slowdown in activity as witnessed at the moment suggests that the market has entered a period of boredom and a low interest coming from crypto traders and investors in trading the flagship decentralized finance (DeFi) asset.

It is also important to note that, as a result of declining transaction fees and in combination with reduced crypto mining rewards after the latest Bitcoin halving event earlier this year, the amount of BTC sold by miners on crypto exchanges could continue to increase.

As recently reported by CryptoQuant, the amount of Bitcoin sold by miners in exchanges has hit a two-month high following factors like a reduced mining reward and lower transaction fees, exerting a strong selling pressure on the price of the maiden crypto asset.

Bitcoin price analysis

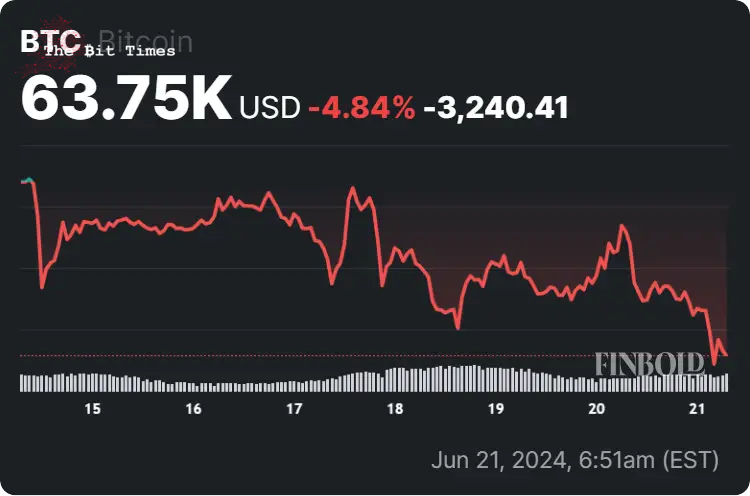

Meanwhile, Bitcoin is changing hands at the price of $63,750, which suggests a decline of 3.53% in the last 24 hours, as well as a 4.84% drop across the previous seven days, adding up to the accumulated loss of 8.85% on its monthly chart while holding onto the 53.56% gain this year so far.

All things considered, the low Bitcoin transaction fees reflect the current mood in the crypto market, which is strongly leaning toward bearish. However, as history has shown, trends in this industry tend to change, sometimes without any warning, so doing one’s own research is necessary when investing.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Nhận xét

Đăng nhận xét