Analyst revises MicroStrategy stock price target

The world’s largest corporate holder of Bitcoin (BTC), MicroStrategy (NASDAQ: MSTR), was one of the best-performing stocks in the Nasdaq-100 index in 2024. Over the course of last year, the price of a single MSTR share surged by 342%.

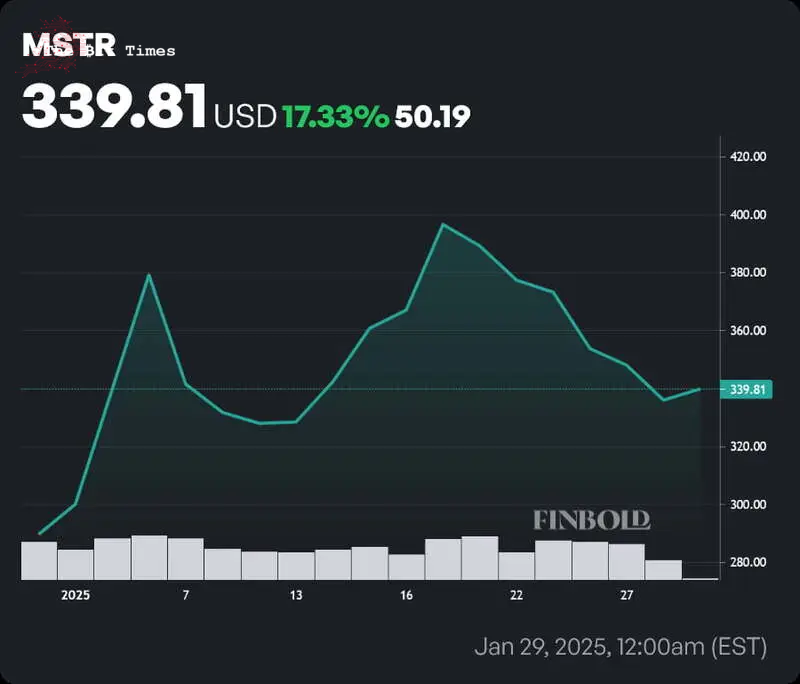

Since the beginning of 2025, MicroStrategy stock has rallied by 17.33% and was changing hands at a price of $339.81 at press time on January 29.

MicroStrategy’s fate is directly tied to Bitcoin’s performance — and although the company’s co-founder and chairman, Michael Saylor, has recently softened his stance on other cryptocurrencies, the business is still all in on BTC, and has not included other digital assets in its holdings.

Picks for you

In order to finance its acquisitions of Bitcoin, MicroStrategy has issued a vast quantity of shares — sparking worries about dilution. However, Saylor and Co. are confident that Donald Trump will bring about a sufficient regulatory shift via executive orders to start a crypto renaissance. One major Wall Street firm seems to agree.

Mizuho sees significant upside in the cards for MicroStrategy stock

On January 29, Mizuho senior equity researcher Dan Dolev initiated coverage on MicroStrategy stock with an ‘Outperform’ rating. The analyst set a price target of $515 for MSTR shares — which equates to a 51.55% upside from current prices.

Further clarifying his outlook, Dolev cited several reasons behind his bullish stance in a note shared with investors.

The analyst expects that MicroStrategy will continue with its bold acquisition strategy. Although he added that Bitcoin itself lacks intrinsic value, Dolev also opined that the price of BTC will continue to rally on rising global adoption, a slowing rate of supply growth, and a favorable political environment — although extreme volatility remains likely.

Mizuho believes that MSTR stock merits a roughly 75% premium to the underlying value of its Bitcoin holdings. Per the firm’s sum-of-the-parts (SOTP) valuation, with Bitcoin prices at a compound annual growth rate of 25% to 30%, a 9x multiple on the value generation of the company’s treasury options, and a 1-2x multiple on its low-growth software business.

Although ambitious, Dolev’s price target does not represent a fringe opinion — analysts from Bernstein, Benchmark, and TD Cowen had previously set even higher price targets — reflecting Wall Street’s generally bullish view on the stock.

Featured image via Shutterstock

Nhận xét

Đăng nhận xét