Bitcoin Price Prediction: BTC Breaches $114K After Cool PPI Data As Focus Turns To CPI Today

The Bitcoin price climbed more than 1% in the last 24 hours to trade at $114,087.95 as of 4:10 a.m. EST, boosted by PPI data that came in lower than expected yesterday.

Weaker producer prices inflation is a sign that costs are not rising as quickly through the supply chain, and in the current macro backdrop that means there’s more room for the US Federal Reserve to cut interest rates.

🚨US PPI & Core PPI Data Just Released.🇺🇸

➡️PPI (MoM)

🔴Previous: 0.9%

🔴Forecast: 0.3%

🟢Actual: 0.1%➡️PPI (YoY)

🔴Previous: 3.3%

🔴Forecast: 3.3%

🟢Actual: 2.6%PPI data came way below expectations 🔻

Fed is too late to cut rates!? pic.twitter.com/frwBhiJUAh

— Brian Rose, Founder & Host of London Real (@LondonRealTV) September 10, 2025

As a result, the Bitcoin price jumped from consolidation near $111,000 to over $114,000.

This move higher was supported by a clear bounce from the 50-day simple moving average, which sits just above the current price zone.

The PPI report was the cherry on top. It seems to have erased yesterday’s panic over the adjusted NFP numbers and triggered a rally that pushed $BTC price back above the trend line.

Expecting resistance around the 50-Day SMA which is close to the psychological $115k level. https://t.co/ReYgbQWng7 pic.twitter.com/VBtqTH4cBr

— Keith Alan (@KAProductions) September 10, 2025

Trading volumes remain steady, and the mood in crypto markets is optimistic as investors now await fresh signals from the US CPI report later today.

Bitcoin Price: On-Chain Metrics Are Supportive

On the on-chain side, Bitcoin metrics remain supportive of the uptrend. Exchange wallets continue to see outflows, meaning more BTC is moving to cold storage as holders expect long-term gains.

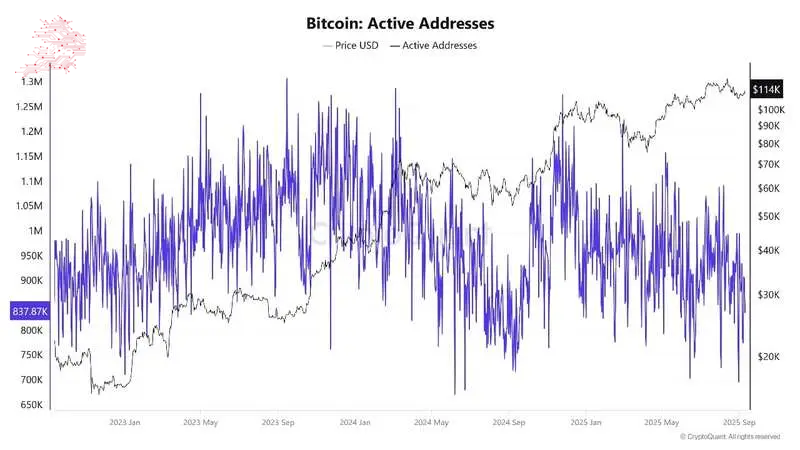

This reduces available supply on trading venues and can fuel upward moves in the coin price as new demand appears. The active address count does not show major surges, but there’s a clear trend of more steady, long-term holders keeping coins off exchanges rather than flipping for quick profits.

BitcoinActive Addresses Source: Cryptoquant

Speculative activity in derivatives is contained for now, and no large-scale liquidations have been seen on recent price swings. These on-chain signals point to a steady, net-positive environment for Bitcoin price in the medium term.

Bitcoin Price: Technical Barriers And Support

On the daily BTCUSDT chart, Bitcoin is now trading at $114,114, with a session high of $114,459. The coin price has broken out above the consolidation zone between $111,000 and $114,000, which had held Bitcoin in a tight range for nearly a month.

BTCUSD Analysis Source: Tradingview

The major resistance to watch is at $124,474, which marks the next target for bulls. This level coincides with recent swing highs and represents the upper boundary for the next leg up. If Bitcoin price can clear this barrier, there is room for a further run toward $130,000 in the near term.

Support comes in at two key zones. The first is near $111,008, which marked the top of the recent consolidation; a drop back to this area should find willing buyers if there is a pullback. The second, longer-term support is at the 200-day simple moving average, currently at $102,066.56.

As for indicators, the Relative Strength Index (RSI) is at 54.76, well below overbought, suggesting there is space for more upside before traders become aggressive sellers. The MACD line is deeply positive at 573.69, reinforcing the ongoing bullish trend.

Meanwhile, the Average Directional Index (ADX) at 14.51 reflects a healthy trend but not yet at the extremes seen during major breakouts.

Bitcoin has a clean technical path toward higher levels as long as macro data remains supportive. A cool CPI print today could spark renewed buying and bring $124,000 into reach quickly.

If the price dips, it is likely to find firm ground well above the 200-day average, keeping the broader trend intact. The trend direction remains upward, and today’s inflation report may tip the balance for the next move.

Related Articles:

- Jack Ma’s Ant Digital Unit To Tokenize $8.4 Billion In Energy Sector Assets

- Crypto Exchange Gemini Secures $50 Million Funding From Nasdaq Ahead Of IPO

- OpenSea Creates An NFT Reserve – Allocates +$1M For Digital Art

Nhận xét

Đăng nhận xét